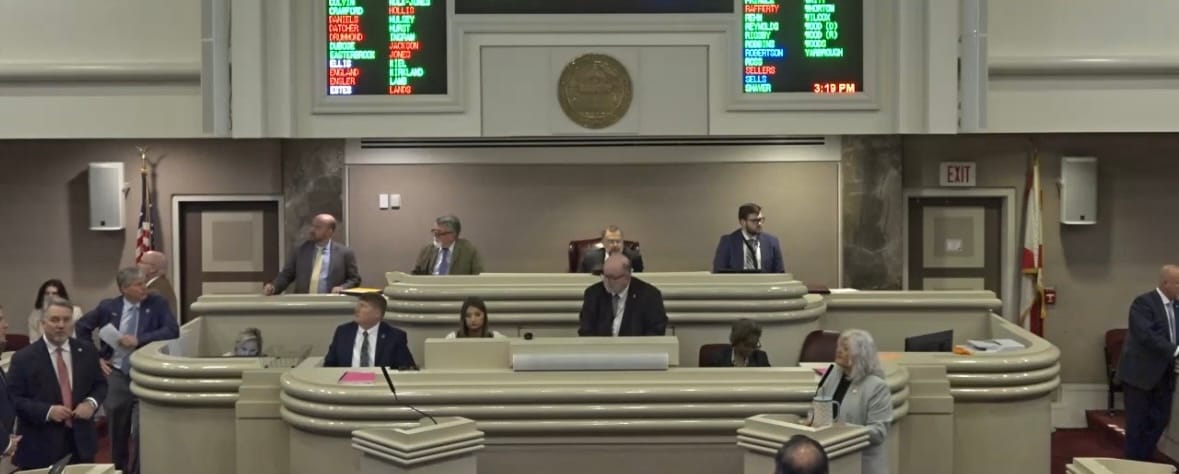

Alabama House Passes Tax Relief Package

Package that includes food sales tax cut now goes to Senate

The Alabama House passed a $191.6 million tax cut package on Tuesday, March 18, 2025, targeting relief for families, seniors, and taxpayers. The four-bill package was sponsored by Rep. Danny Garrett (R-Trussville).

The package includes HB386 and HB387, which reduces the state’s grocery tax by 1% and allows municipalities greater flexibility to lower their local grocery taxes. The grocery tax has been a focal point of legislative efforts since 2023, when Governor Kay Ivey signed a bill reducing it to 3%.

HB388 provides tax relief for seniors by expanding an existing exemption on state income tax for withdrawals from 401(k) and IRA accounts. It builds on a 2023 law that exempted the first $6,000, now increased to $12,000 to provide broader relief.

Income tax deduction increases in HB389 allow Alabamians to deduct more federal income taxes, aligning with a long-standing state policy but offering new savings amid rising costs.

The passage comes as Alabama’s Education Trust Fund (ETF) shows a surplus, enabling tax cuts without jeopardizing education funding, a concern that has stalled grocery tax reductions since the 1990s.

House Speaker Nathaniel Ledbetter (R-Rainsville), a key supporter of the package, highlighted the state’s fiscal stability, noting over a dozen tax cuts since 2022 that saved families thousands while paying off state debt and issuing $393 million in rebates.

Critics argue that the grocery tax cuts remain insufficient. They call for its complete elimination, reflecting ongoing public debate about food affordability in Alabama. It’s estimated that 17 percent of adults and 23 percent of children in Alabama experience food insecurity.

The package now moves to the Alabama Senate.