Alfa Health Plans Now Open for Enrollment Across Alabama

Applications opened October 1 and are being accepted through Alfa Insurance agents and the dedicated Alfa Health team.

The Alabama Farmers Federation has officially launched Alfa Health Plans, a new health care option now available to members statewide. Applications opened October 1 and are being accepted through Alfa Insurance agents and the dedicated Alfa Health team.

“Alfa has been a trusted brand for families in this state for decades. We are proud to add Alfa Health Plans to our product lines for home, auto and life coverage,” said Federation and Alfa President Jimmy Parnell. “I’m convinced Alfa Health Plans will help the people of Alabama access more affordable health care while improving their quality of life.”

Alfa Health Plans will offer year-round enrollment with options for individuals and families. Coverage includes preventative care, prescription drugs, dental, and vision services. Members can also choose a major medical plan for catastrophic protection or a high-deductible plan that qualifies for a Health Savings Account.

“With our members facing the worst economic crisis since the 1980s, we were determined to provide this cost-saving option as quickly as possible,” Parnell said. “I can’t thank our staff and leadership enough for their work to bring these products to market in just five months.”

The Farmers Federation has offered health coverage to members since 1968, including traditional health insurance and Medicare supplements in Alabama, Georgia, and Mississippi. Parnell said the new plans are a continuation of that mission.

“Alfa Health Plans coverage is just another tool to help us better serve our members,” he said.

The new program was made possible by legislation signed into law by Gov. Kay Ivey. The measure, sponsored by Sen. Arthur Orr (R-Decatur) and Rep. David Faulkner (R-Mountain Brook), cleared the way for the Federation to bring these products to market.

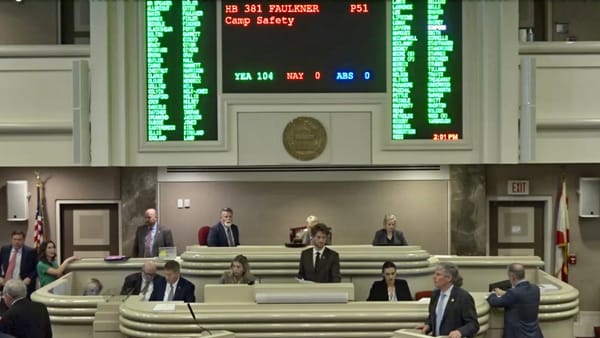

The initiative began in April, when the Alabama House passed HB 477 by a vote of 98–1 following more than two hours of debate.

State Representative David Faulkner, the House sponsor, framed the push in economic and social terms. “The rising cost of healthcare is a significant burden for our farmers,” he told lawmakers. He predicted ALFA plans could save members 30 % to 60 % compared to conventional coverage.

Opponents raised concerns on the House floor. Democratic Representative Juandalynn Givan (D-Birmingham) asked whether Black ALFA members had been counted, and later warned that the bill resembled an assault on the Affordable Care Act. Other critics questioned how the new plans might affect future Medicaid expansions. Faulkner countered that HB 477 would not interfere with Medicaid policy.

The bill included several amendments. One mandated that licensed agents must sell the plans. Another guaranteed that once enrolled, a person could not be dropped for one health event. A prescription drug benefit and substance use treatment coverage were also added.

Next came the Senate. The Senate Banking and Insurance Committee advanced a revamped version of the bill, SB 232, amid criticism from consumer and insurance groups.

Senator Arthur Orr, the sponsor, defended the plan as a way to fill gaps for those unable to get employer plans or government aid. But critics—including Blue Cross & Blue Shield of Alabama—argued that allowing ALFA to sell under lighter regulation would distort the insurance market and weaken protections. Consumer advocates voiced fear that individuals with preexisting conditions could be left vulnerable or face discriminatory enrollment practices.

Senator Vivian Davis Figures questioned whether ALFA might cherry-pick healthier members to reduce cost, leaving sicker people with fewer options.

On May 7, Governor Kay Ivey signed HB 477 into law. The bill became effective June 1, 2025.

At the signing event, Ivey praised the bill, saying she was “pleased to sign HB 477 to create a good health coverage option that aims to help our farmers.” Alfa President Parnell thanked her, noting that farmers and small business owners face especially steep barriers to health coverage. “We are excited to help our members address soaring health care costs,” he said at the signing.

Parnell has framed Alfa Health Plans as an extension of ALFA’s long tradition of offering insurance products—now expanded into health insurance. He asserts it aligns with ALFA’s mission to serve its membership.

Alfa Health Plans will now accept year-round applications via ALFA Insurance agents and the Alfa Health team. Coverage spans preventive care, prescriptions, dental, and vision. Members can choose “major medical” coverage for catastrophic events or high-deductible plans that qualify for Health Savings Accounts.

The plans will use the UnitedHealthcare network and be administered by the Tennessee Farm Bureau.

That choice has drawn criticism. Some point to UnitedHealthcare’s low satisfaction ratings and complaints of claims denials—a sensitive issue for any insurer seeking public trust.

Supporters hope that Alfa Health Plans will offer more affordable alternatives, particularly for self-employed farmers and members who fall into gaps between employer coverage and government programs. Critics worry about weaker consumer safeguards, unequal risk pools and UnitedHealthcare’s poor reputation.

The success of the initiative—and whether it truly delivers on cost and coverage—will be closely watched across Alabama.

For more information about Alfa Health Plans, contact an Alfa Insurance office in Alabama, visit AlfaHealth.net or call 1-800-619-9356.