Minnesota Fraud Scandal: Charges, Billions, Terror Fears

DOJ charges 98 in wide fraud probe tied to Minnesota social services; federal agents comb daycare sites as terror funding fears loom

Nearly 100 people have been charged thus far as a result of a sweeping federal fraud investigation in Minnesota into a scheme tied to daycare and other social-service funding. Authorities say the alleged fraud drained taxpayer dollars and pushed officials to send agents “door-to-door” at suspected sites.

Attorney General Pamela Bondi announced Monday that the Department of Justice has charged 98 individuals in connection with the probe, and 85 of those charged are of Somali descent. More prosecutions are expected as the investigation progresses.

Bondi credited independent journalist Nick Shirley’s viral videos on social media for drawing broader attention to the issue, saying it “helped show Americans the scale of fraud in Minnesota.” In his reported, Shirley has documented several childcare centers that he alleges were receiving millions of dollars in public funds despite appearing inactive or empty.

Federal law enforcement has now mobilized in Minneapolis in response to these fraud allegations tied to daycare subsidies and broader welfare programs. Department of Homeland Security Secretary Kristi Noem said agents are conducting a “massive investigation on childcare and other rampant fraud,” including going “door-to-door” at businesses being reviewed. FBI Director Kash Patel described the work as dismantling “large-scale fraud schemes exploiting federal programs.”

Minnesota’s woes aren’t limited to a single program. In the pandemic era, the nonprofit Feeding Our Future—once lauded as a hunger-relief outfit—turned out to be one of the largest fraud cases in U.S. history, with more than $300 million in federal child-nutrition dollars siphoned off while few meals reached children’s hands.

Federal prosecutors have more recently targeted Medicaid programs and other welfare funds tied to autism therapy claims, housing services, and daycare subsidies, alleging staggering increases in payments without corresponding services provided. Some claims paid through Minnesota’s autism programs surged from just $3 million in 2018 to nearly $400 million by 2023.

A former DHS investigator told lawmakers that fraud involving the Child Care Assistance Program may have topped $100 million annually as far back as 2014–2018, with checks issued for services never delivered. At the same time, surveillance from older daycare fraud cases shows records of children being signed in and out so centers could bill the State—even when no services were rendered.

Where did all that money go? That’s become a central question—and a highly controversial one.

Independent investigations published in City Journal and other outlets have claimed that millions of dollars swindled from State and federal programs have been funneled overseas through informal money networks known as hawalas, which are commonly used in the Somali diaspora to send remittances back home. These reports suggest some of that money eventually touched areas controlled by the al-Qaeda-linked terrorist organization Al-Shabaab.

A confidential source quoted in those reports went as far as saying, “The largest funder of Al-Shabaab is the Minnesota taxpayer.”

State legislative reviews after earlier media stories acknowledged that cash from fraud could possibly reach extremist groups in war-torn nations—but found no definitive evidence linking Minnesota childcare funds directly to terrorist financing.

Still, recent Congressional whistleblower letters have alleged that remittances tied to fraud money were moving overseas through hawala networks for years, beginning as far back as 2014, and urged deeper federal scrutiny of remittance oversight.

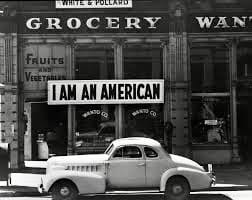

A large share of the defendants charged in federal fraud cases are “individuals of Somali descent,” many tied to nonprofits, clinics, or services that billed Medicaid and other programs. That reality has made the issue politically fraught. Supporters of Minnesota’s Somali community warn against broad generalizations, noting that fraud exists in all groups and stressing that remittances are also used to support families abroad.

But political critics have seized on the revelations. U.S. Senator Ted Cruz blasted Minnesota leadership, alleging billions flowed from welfare programs into remittances overseas and pointing to the viral daycare video as illustrating systemic failure.

When asked about the allegations and investigation earlier in December, Minnesota Governor Tim Waltz said “These are not law-abiding citizens…There’s a lot of white men who should be holding a lot of white men accountable.”

Amid the intensifying crackdown, FBI Director Kash Patel has signaled that immigration consequences are under review: some individuals implicated in fraud cases are being referred for potential denaturalization and deportation proceedings.

Those steps mark a significant shift in how federal authorities respond to fraud tied to public benefits, especially when tied to noncitizens. Immigration advocates argue such moves risk unfairly targeting immigrant communities, while others see them as necessary to uphold the integrity of federal programs and a reasonable punishment for committing fraud-related crimes.

Investigators and whistleblowers have said warnings about fraud in Minnesota’s welfare system date back more than a decade, with some early probes into daycare subsidy abuse allegedly faltering without significant prosecutions. Questions now swirl about how oversight agencies missed massive growth in questionable claims, and whether political sensitivity about immigrant communities contributed to delayed action.

Besides citizen journalist Nick Shirley, others have begun working to bring transparency to day care funding. Andrew Torba, founder of the Gab social media platform, and other Gab users have created DayCareData.com, which aggregates data and allows searches of the funding and political contributions of day care centers in 16 States—California, Texas, Ohio, Illinois, Minnesota, Pennsylvania, Missouri, Connecticut, Colorado, Kentucky, New Jersey, Washington, Delaware, Florida, and Michigan.

While Minnesota faces one of the largest public-benefits fraud probes in the nation, Alabama has not seen anything approaching that scale. Still, recent cases show that fraud tied to taxpayer-funded programs is not unique to one State—and that enforcement matters.

In 2024 and 2025, federal prosecutors charged three Pike County residents, including a sitting Police Chief, in connection with a scheme to defraud the Emergency Rental Assistance Program, a pandemic-era relief effort funded by federal dollars. The U.S. Department of Justice said accused the defendants of submitting false applications and laundering the proceeds. The charges include wire fraud, money laundering, and aggravated identity theft.

Alabama has also seen daycare-related fraud cases, though on a far smaller scale than Minnesota. In 2019, daycare operators pleaded guilty to public assistance fraud after falsely billing childcare subsidy programs, resulting in restitution orders and prison sentences.

State agencies continue to warn of ongoing SNAP and EBT fraud, including card-skimming schemes that drain benefits from low-income families—a problem Alabama officials say has increased nationwide.

The differences between Alabama and Minnesota are related to size, scale, duration and response.

Alabama’s cases tend to involve thousands or hundreds of thousands of dollars, with prosecutions following relatively quickly once fraud is uncovered. Minnesota’s scandals, by contrast, involve hundreds of millions (id]f not billions) of dollars, allegations that warnings were ignored for years, and unresolved questions about where the money ultimately went.

For taxpayers, the lesson is blunt: fraud thrives where oversight fails—and stops where enforcement begins.