Mississippi Moves To Eliminate State Income Tax

Bill reduces tax to 3%, when revenue needs may be reevaluated

Mississippi is moving to reduce, and possibly eliminate, its state income tax. If successful, it would join Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming in having no tax on personal income.

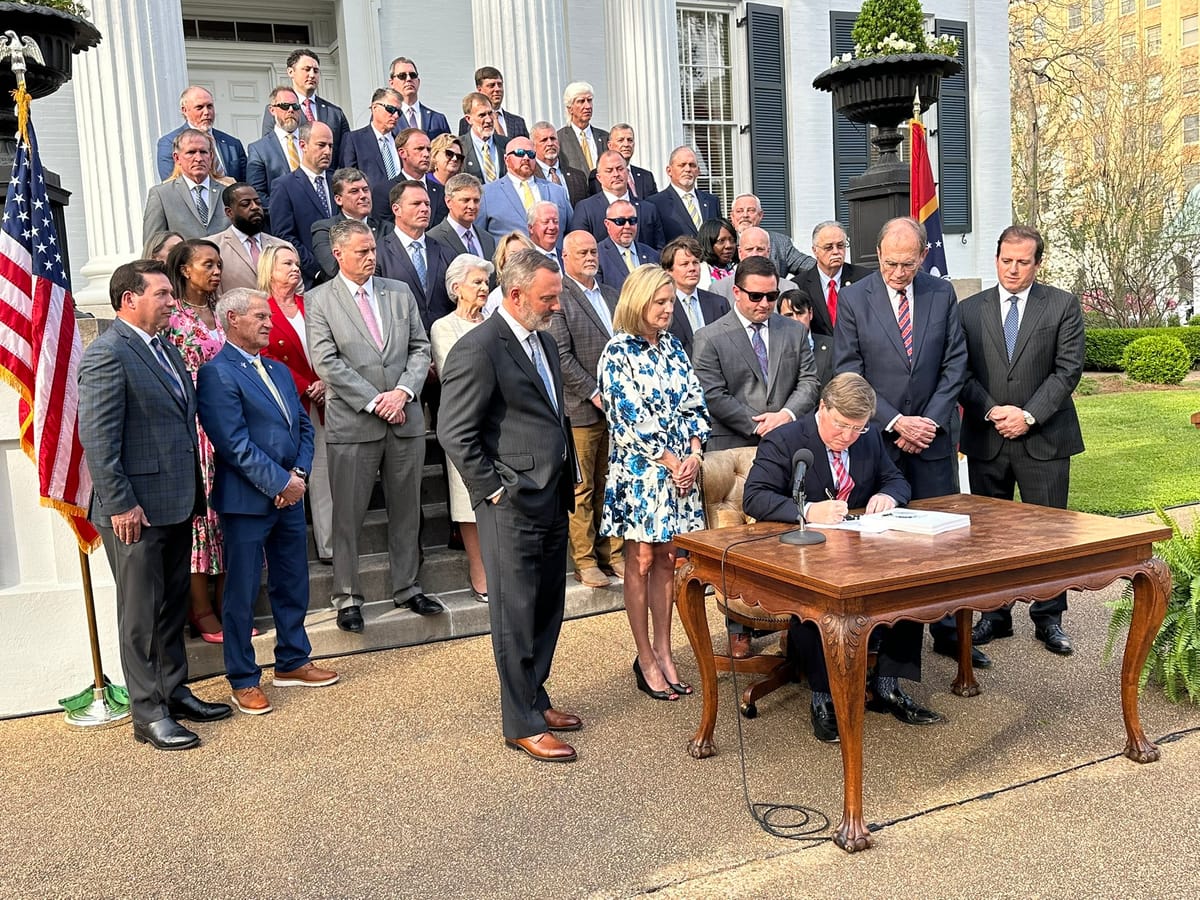

Mississippi Governor Tate Reeves signed a sweeping tax overhaul on Thursday, March 27th. The legislation, however, passed under unusual circumstances—many lawmakers “inadvertently” voted for it due to typographical errors in the bill’s language.

Mississippi has already begun reducing its income tax rate from 5% to 4%, under a previous tax cut. The newly signed legislation will further reduce the rate by 0.25% per year starting in 2027, eventually reaching 3%. After 2031, the phase-out will only continue if the state meets specific revenue “growth triggers.”

The law also reduces the grocery sales tax from 7% to 5%, raises the gasoline tax from 18.4 cents to 27.4 cents per gallon over three years to fund infrastructure, and alters the public employee retirement system’s funding model.

Mississippi House leaders have long pushed for swift income tax elimination. Senate officials had advocated a more cautious, gradual approach, citing concerns over cutting one-third of the state’s revenue. Senators had also insisted on including economic growth triggers to ensure the tax phase-out would not jeopardize state finances. However, due to typographical errors in the bill, those safeguards were effectively nullified, accelerating the tax’s elimination almost to the pace originally sought by the House.

These typographical errors have caused the bill to be labeled the “typo tax.” These errors allegedly caused some Senators to “inadvertently” vote for the bill, including the errors. The House quickly passed the “flawed” bill to the Governor, who signed it into law.

Gov. Reeves hailed the tax plan as a historic achievement, predicting it would drive economic growth and attract businesses and workers to the state.

“Today is a day that will be remembered not just for the headlines, not just for the politics, but for the profound generational change it represents,” Reeves stated at a signing ceremony in front of the Governor’s Mansion. “After many, many, many years of hard work, we can all stand together and say that we have accomplished income tax elimination in the state of Mississippi.”

While Reeves has praised the tax cuts as a boon for economic growth, critics argue they could significantly strain Mississippi’s budget. Neva Butkus, a senior analyst at the Institute on Taxation and Economic Policy (ITEP), estimates the loss of income tax revenue could cut the state’s general fund by $2.6 billion—a substantial reduction for a state with a $7 billion budget.

“What the state is essentially committing to is a very extreme and dramatic loss of revenue during a very tumultuous time,” Butkus warned. “And they’re doing all of this while creating a windfall for the state’s wealthiest residents in the poorest state in the union.”

ITEP data shows that lower-income Mississippians—those earning less than $19,300 annually—already pay a higher percentage of their income in taxes (12.4%) compared to those earning more than $362,000 (6.9%). The tax changes, particularly the increased gas tax, could widen this disparity.

Conversely, Joe Bishop-Henchman of the National Taxpayers Union Foundation argued that, despite the errors in the bill’s wording, the state’s existing growth triggers provide some fiscal protection.

“A value of triggers is that it still leaves room for budget growth,” Bishop-Henchman noted.

Municipal officials across Mississippi remain divided over the tax overhaul’s impact. Some mayors welcome the increased allocation of grocery sales tax revenue to local governments, while others fear deep cuts to the state’s general fund could undermine essential public services.

Shari Veazey, executive director of the Mississippi Municipal League, noted that her organization did not oppose the bill, citing assurances that localities would not see revenue losses from the grocery tax changes.

However, Greenville Mayor Errick Simmons warned that rural communities could bear the brunt of the financial strain.

“The trickle-down negative effects of this tax overhaul will not actually trickle down—it will be a huge take-away from this rural community,” Simmons said. “When local governments lose the ability to fund police, fire, and other essential services, the safety and well-being of our residents are put at risk.”

As Mississippi embarks on this unprecedented tax policy shift, the long-term effects remain uncertain. Supporters argue that lower taxes will attract new businesses and residents, while critics fear that vital state services could suffer under a reduced budget.

“We are saying to entrepreneurs, to workers, to dreamers: Mississippi is open for business, and we will not penalize your success,” Reeves declared. “We are going to compete and we are going to win.”

Whether the state’s economy thrives under this new policy—or struggles to fill a multi-billion-dollar budget gap—remains to be seen.

Governor Reeves statement, as posted on X, may be read HERE.