Trump, Tuberville, Britt Laud Senate Passage of the One Big Beautiful Bill

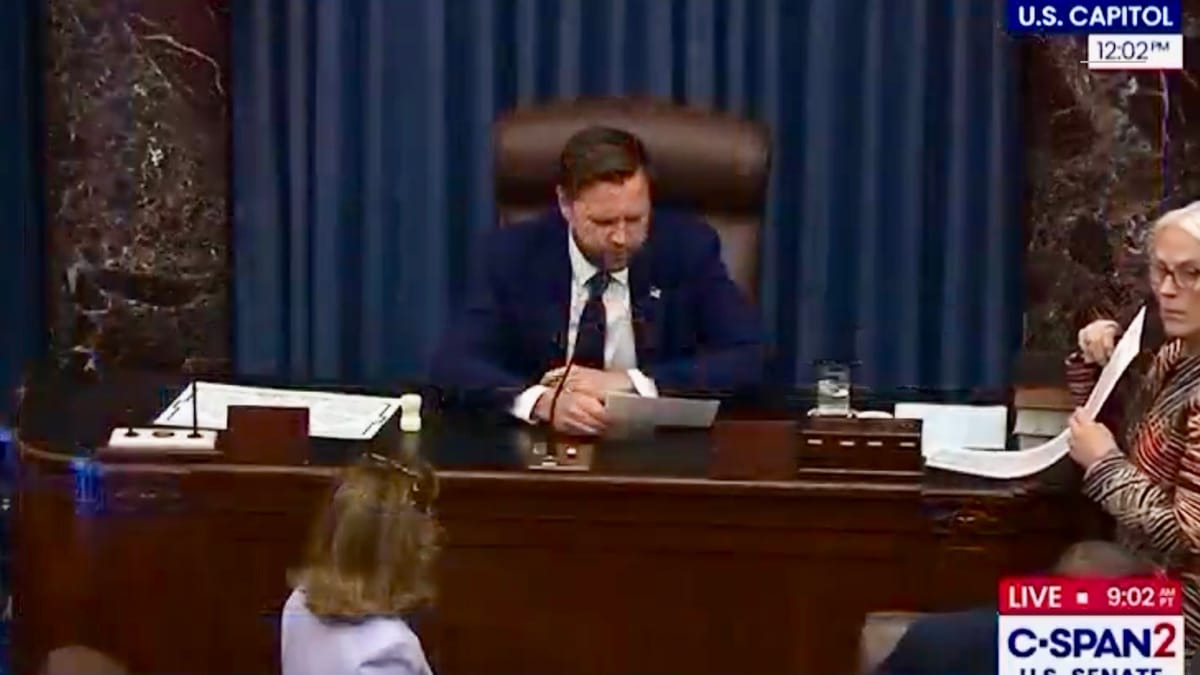

VP Vance cast tie-breaking vote as bill passes 51-50

In a tight 51–50 vote along party lines, the U.S. Senate passed the sweeping “One Big Beautiful Bill” (OBBB), which promises the largest tax cut in American history. The legislation now heads to the House.

Vice President J.D. Vance cast the tie-breaking vote after three Republicans—Rand Paul, Thom Tillis, and Susan Collins—joined Democrats in opposing the bill.

President Trump took to Truth Social to say:

“Almost all of our Great Republicans in the United States Senate have passed our “ONE, BIG, BEAUTIFUL BILL.” It is no longer a “House Bill” or a “Senate Bill”. It is everyone’s Bill. There is so much to be proud of, and EVERYONE got a major Policy WIN — But, the Biggest Winner of them all will be the American People, who will have Permanently Lower Taxes, Higher Wages and Take Home Pay, Secure Borders, and a Stronger and More Powerful Military. Additionally, Medicaid, Medicare, and Social Security Benefits are not being cut, but are being STRENGTHENED and PROTECTED from the Radical and Destructive Democrats by eliminating Waste, Fraud, and Abuse from those Programs.”

Alabama’s senior Senator, Tommy Tuberville, also posted on social media that:

"The road to Making America Great Again runs through the One Big Beautiful Bill.

“President Trump campaigned on popular policies like No Tax on Tips, No Tax on Overtime, and No Tax on Social Security - and this bill turns those policies into law. We're cutting taxes for everyone—doesn't matter if you are rich or poor, urban or rural, a CEO or a lineworker.

“This bill codifies every part of President Trump's agenda that 77 million Americans wholeheartedly voted for.

“President Trump promised, and Senate Republicans delivered."

Sen. Katie Britt emphasized several provisions aimed at easing the financial burden on middle- and working-class Americans. She noted that the bill “prevents the largest tax hike in American history—amounting to nearly $2,200 saved for the average Alabama household.”

The Senate package includes more than $600 billion in targeted relief, including permanent updates to the Child and Dependent Care Tax Credit (CDCTC) and the Employer‑Provided Child Care Credit (45F). These credits, last updated in 2001 and 1986 respectively, now address a 263% inflation rise in child care costs.

Sen. Britt hailed these changes, saying, “I’m proud to have been the tip of the spear in updating critical child care provisions… affordability and accessibility of child care are barriers for parents across our state and nation.”

As a non‑expansion Medicaid state, Alabama benefits from preserved provider taxes at 6%, protecting the revenue stream. The bill boosts rural hospital funding nationwide, with Alabama slated to receive at least $500 million over five years.

The Senate bill allocates $4.1 billion for NASA’s SLS rockets for Artemis IV and V, plus $1 billion for manned‐spaceflight infrastructure. That includes a $100 million package for Huntsville’s Marshall Space Flight Center. In security matters, the package offers $130.3 billion for border and DHS needs.

The legislation lifts the cap on royalties from Gulf oil and gas production, encourages new coal leases, and expands energy tax credits to include metallurgical coal. Alabama’s farmers will benefit from higher reference price and base acres. A $105 million program—championed by Tuberville, Britt and Rep. Barry Moore (R-AL1)—funds feral swine eradication, and the death tax exemption threshold is raised—protecting over 37,000 family farms in the state.

While the reconciliation bill includes cuts to Medicaid and SNAP—opposed by some Republicans—it secures protections for Alabama. Additionally, it halves funding to the Consumer Financial Protection Bureau.

The House will review the bill by Wednesday as Republicans aim to finalize it before the July 4 deadline and send it to the President for his signature.